Emerging Companies / Venture Capital (EC/VC)

Scroll down to view and listen to content related to EC/VC practice. We are adding content to our site on an ongoing basis – be sure to subscribe to our newsletter below to stay updated!

EC/VC practice involves representing startups, venture capital funds, and other entities on investments and other deals. This can range from a startup’s first investment (known as a “seed” investment) to later stage investments, such as Series A, Series B, and so on, as well as lending transactions with startups.

Like many corporate practices, EC/VC attorneys typically serve as generalists on behalf of startup clients, helping the company with ongoing corporate legal matters, such as incorporation documents, board resolutions, filings, as well as overall strategy for fundraising, hiring, employee equity plans, executive- and board-related matters, and other items, in close coordination with the firm’s specialists in intellectual property (IP), employee benefits, labor and employment, tax, and other areas.

Typical day-to-day activity for EC/VC attorneys includes drafting and negotiating investment agreements between the company and investors, performing due diligence by reviewing a startup’s contracts in anticipation of an investment, organizing a company’s “cap table” (list of the company’s shareholders and respective equity ownership amounts), joining companies’ board meetings, and ongoing communication with clients and specialists.

EC/VC can be an attractive option for attorneys interested in working with or opposite growing companies, working on several matters simultaneously, learning the details of how various businesses run, and becoming well-versed in other “specialist” areas.

WATCH

Summer Associate Hub’s video series, where we interview BigLaw attorneys about their practice in under 6 minutes (also known as 0.1 billable hours).

Gabe Choi

Emerging Companies/

Venture Capital (EC/VC) Associate

Check out these short and helpful videos from Hotshot Legal, a video-based learning platform used by top law firms.

Check out these short and helpful videos from Hotshot, a video-based learning platform used by top law firms and law schools.

These videos are a great way to get an overview of EC/VC practice, to determine if this practice area is right for you, and to prepare for networking calls and interviews.

These links will direct you to Hotshot’s website, where you can sign up for a free trial and access to 3 free courses. To watch more, use promo code “SAHub” to get 30% off Hotshot’s student rate (which brings the cost down to just $6 per month). Use your .edu email address to sign up, and if your school already subscribes to Hotshot you’ll automatically be added to its account!

Hotshot

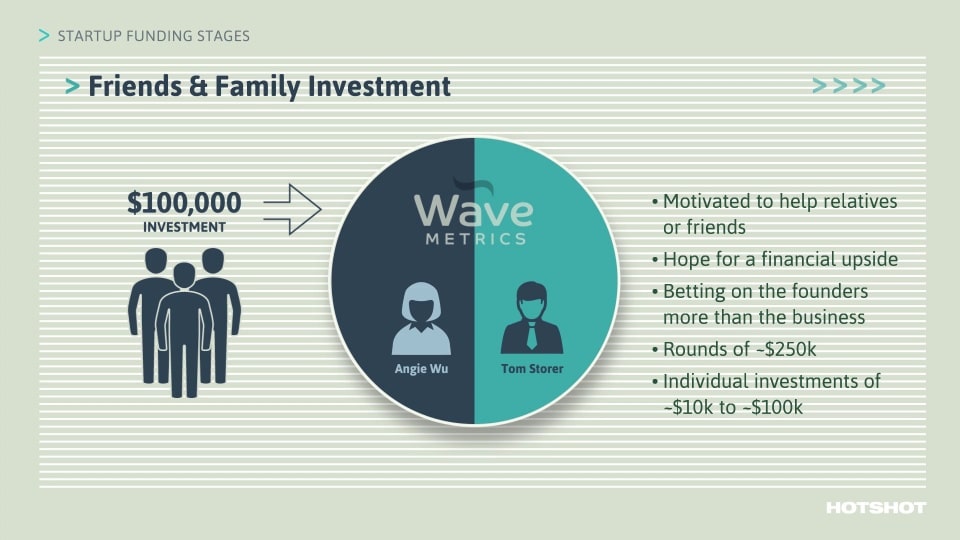

Startup Funding Stages

A company goes through several funding stages as it moves from formation to exit. This course takes a look at each of them and their impact on a company and its founders.

Hotshot

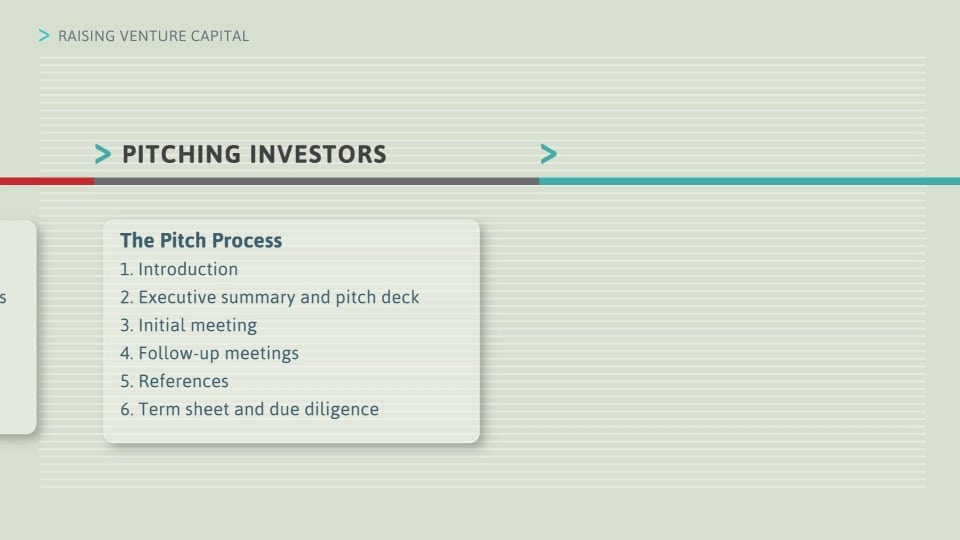

Raising Venture Capital

A look at how emerging companies raise venture capital, from finding and pitching investors to closing a deal.

Hotshot

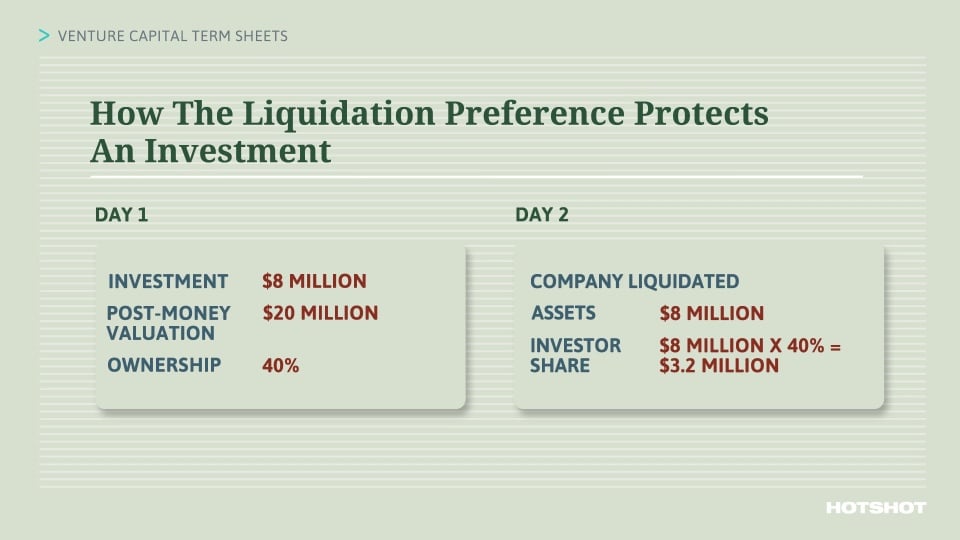

Venture Capital Term Sheets

A discussion of the perspective of companies and investors on the main economic and control rights negotiated in a venture financing term sheet. Includes liquidation preference, anti-dilution provisions, board rights and employment matters.

Hotshot

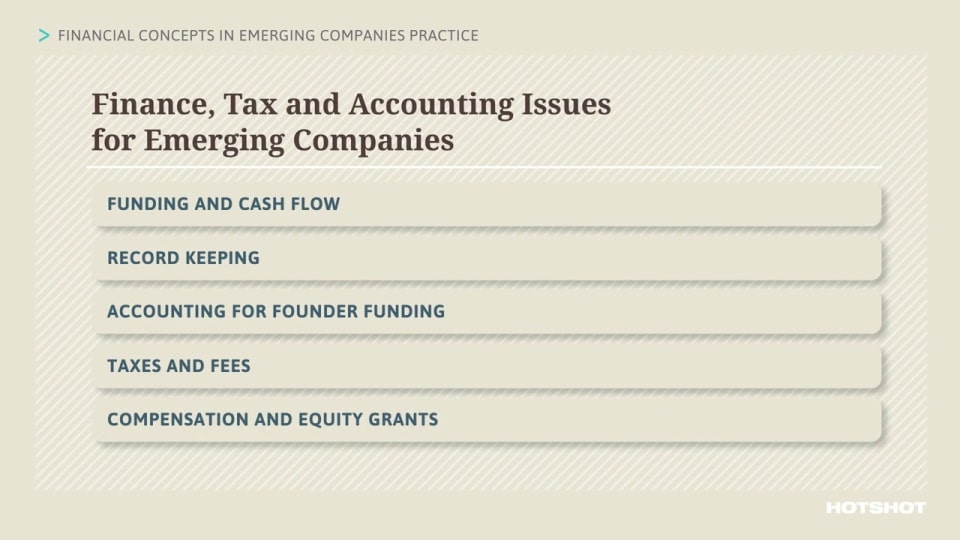

Financial Considerations in Emerging Companies Practice

The key financial concepts in emerging companies practice, including initial startup issues and the financial and accounting issues involved in debt and equity financings.

Hotshot

How to Be an Effective Venture Lawyer

Jason Mendelson of Foundry Group shares his perspective on what makes venture lawyers effective for their clients.

LISTEN

Check out these episodes from the How I Lawyer Podcast, a series by Georgetown Law professor Jonah Perlin.

Jonah talks to attorneys throughout the professions about what they do, why they do it, and how they do it well.

This podcast series is a great way to learn directly from attorneys about what the day-to-day work is like in different practice areas.

Jesse Mosier, Startup General Counsel, former EC/VC BigLaw Attorney

In this episode, Jonah Perlin speaks with Jesse Mosier, who is currently the General Counsel at Migo, a financial technology company, and a former corporate and EC/VC attorney at multiple BigLaw firms.

PRACTICE

Check out these interactive exercises brought to you by Praktio, a modern training platform for reviewing and drafting legal documents. Use these exercises to practice these tasks, make mistakes, and learn from them!

Praktio has teamed up with Summer Associate Hub to make these exercises available to law students for free – these links will direct you to Praktio’s platform, where you may be required to create a free account.

These courses are a great way for law students to get a glimpse of EC/VC practice. We selected these exercises as only some of the key tasks on which EC/VC associates work (and, of course, this practice involves many other types of exercises).

Praktio:

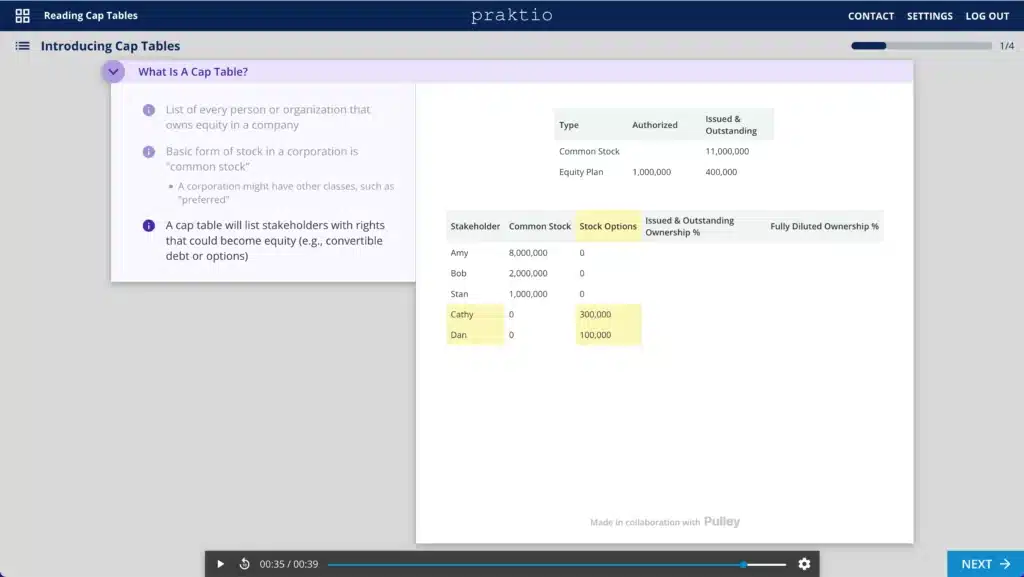

Reading Cap Tables

Learn how to read and reconcile capitalization tables.

Reading cap tables is one of the central skills for EC/VC attorneys. Who said lawyers don't do math?

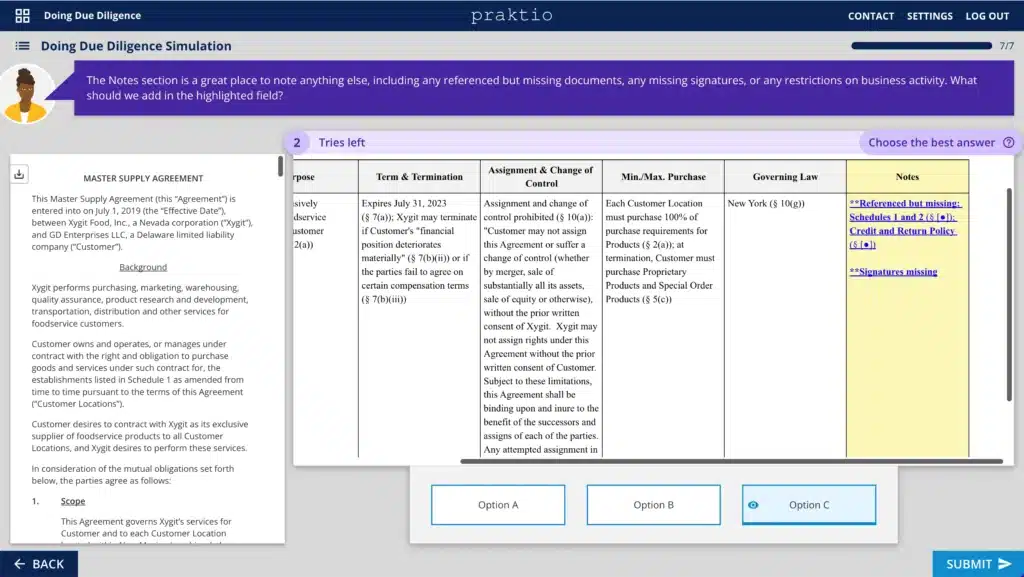

Praktio:

Doing Due Diligence

Learn how to review target contracts and chart key data points for practical use.

Although due diligence is famous as a key stage in M&A transactions, it is also an important part of every venture financing transaction. Due diligence goes hand in hand with drafting disclosure schedules, which are the subject of the exercise below.

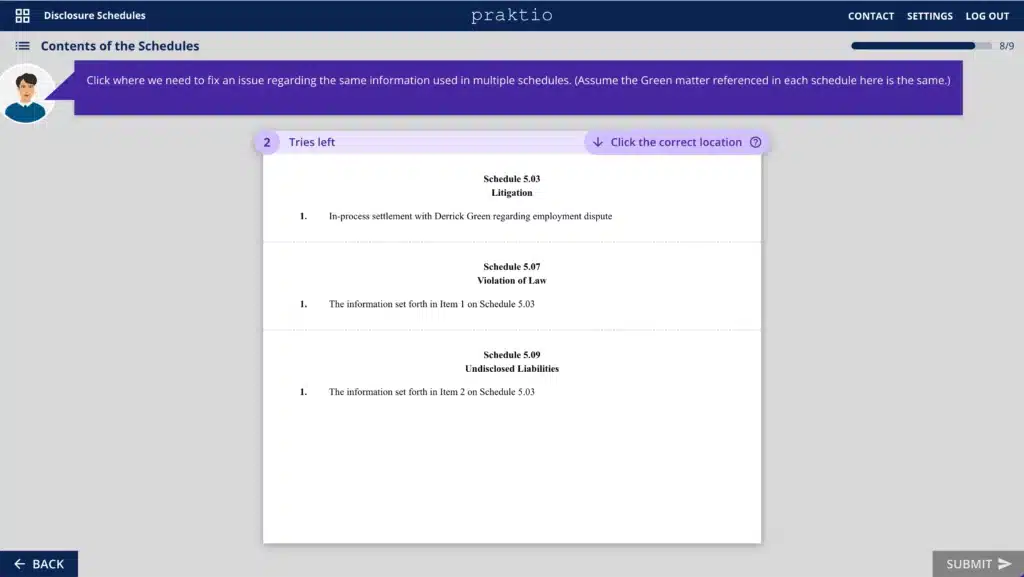

Praktio:

Disclosure Schedules

This course teaches how disclosure schedules work with the larger agreement and the diligence process to allocate risk between the parties.

Disclosure schedules are an important aspect of any venture financing deal, listing the company's material assets, contracts, liabilities, and exceptions to statements made in the investment agreements.

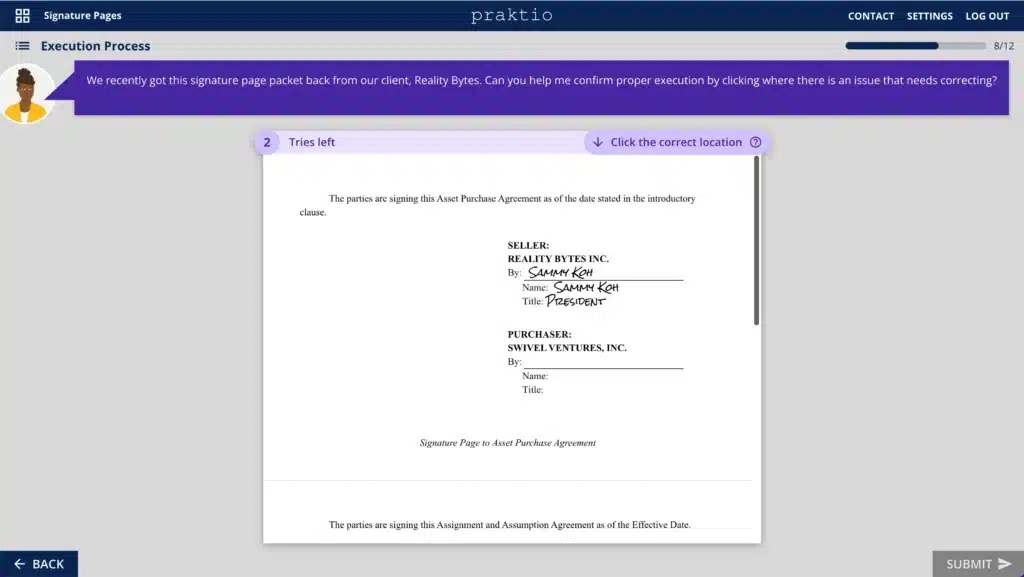

Praktio:

Signature Pages

Learn how to create, confirm, and coordinate signature pages

Signature pages are a key task for junior associates in any corporate practice, including EC/VC. Because it is the vehicle for the actual signing and closing of the investment, organizing accurate signature pages is a very important task for any transaction and something that clients rely on the law firm to handle reliably.