Mergers & Acquisitions

Scroll down to view and listen to content related to mergers and acquisitions (M&A) practice. We are adding content to our site on an ongoing basis – be sure to subscribe to our newsletter below to stay updated!

M&A practice involves representing buyers (the “buy-side”) and sellers (the “sell-side”) in mergers and acquisitions, often referred to as “M&A deals.” M&A deals include companies acquiring or merging with another company, or acquiring a specific business line or other piece of another company.

M&A teams are known as the “quarterbacks” of a deal, coordinating with the client and opposite party on one end and the specialists within the firm on the other end. During the lead-up to the signing (when the parties officially agree to do the deal) and closing (when the money is transferred and the company changes ownership), the M&A team also manages the “checklist,” an important tool to track all of the items required for the deal to sign and close.

M&A attorneys typically perform the following activities during a deal:

– Negotiating the letter of intent (LOI) or term sheet, where the parties preliminarily agree on the terms of the deal.

– Due diligence, where the M&A team reviews the assets, contracts, corporate documents, and other items of the company being acquired, coordinates with specialist groups, such as intellectual property (IP), employment, and real estate, and prepares a due diligence memo for the client, which is an overview of any issues (“red flags”) with the target company.

– The parties negotiate the main merger agreement or stock purchase agreement (or “definitive agreements”) and disclosure schedules, which includes a list of the target company’s material assets, contracts, liabilities, and any exceptions to statements made in the transaction documents. Disclosure schedules are typically handled by junior and mid-level associates in coordination with specialist groups.

– Managing checklists of what needs to be done by signing and by closing of the deal.

– Coordinating the signatures, approvals, wire transfers, and other key steps to completing the transactions.

M&A can be an attractive option for attorneys interested in working on fast-paced deals, being a generalist overseeing different specialist areas, and working on teams. M&A work at large firms can have a “feast or famine” cadence, where attorneys are very busy at some points during a deal and have more free time during other points, such as after signings/closings.

Featuring Goodwin, Proskauer, and Willkie

Watch our interesting and fun panel discussion about the different types of Corporate and Mergers & Acquisitions (M&A) work at top firms, including private equity, public company, and strategic M&A, and how to determine if M&A is the right practice for you.

Featuring:

-Josh Soszynski, Goodwin

-Mike Ellis, Proskauer

-Laura Acker, Willkie

WATCH

Summer Associate Hub’s video series, where we interview BigLaw attorneys about their practice in under 6 minutes (also known as 0.1 billable hours).

Randi Lally

M&A Partner

Sanzana Faroque

M&A Associate

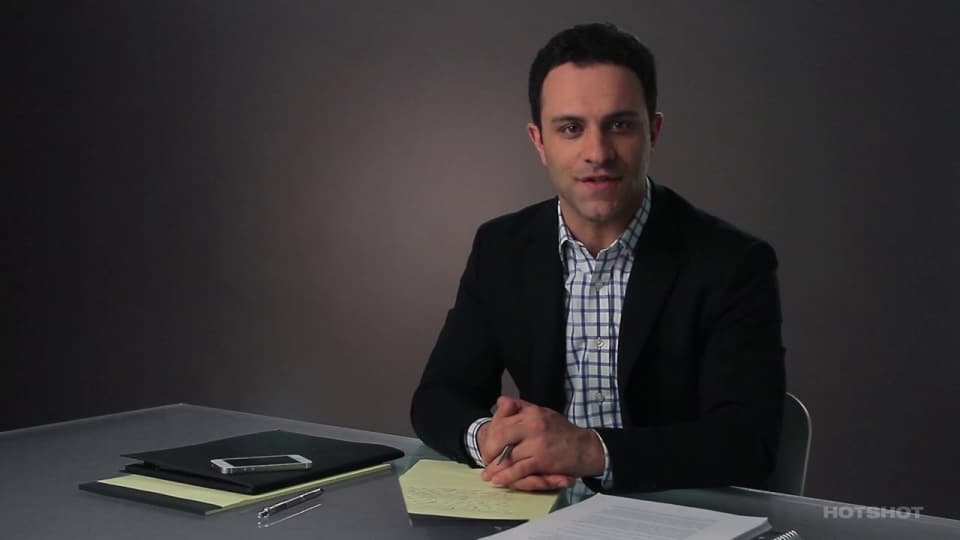

Check out these short and helpful videos from Hotshot, a video-based learning platform used by top law firms and law schools.

These videos are a great way to get an overview of M&A practice, to determine if this practice area is right for you, and to prepare for networking calls and interviews.

These links will direct you to Hotshot’s website, where you can sign up for a free trial and access to 3 free courses. To watch more, use promo code “SAHub” to get 30% off Hotshot’s student rate (which brings the cost down to just $6 per month). Use your .edu email address to sign up, and if your school already subscribes to Hotshot you’ll automatically be added to its account!

Hotshot

M&A Practice

What is M&A practice? What do deal lawyers do? This course will help you understand this practice area, whether you want to be an M&A lawyer or not.

Hotshot

Deal Process Overview

Learn about the overall M&A deal process, from setting up the deal team to the post-closing.

Hotshot

Deal Structures

Understanding deal structures is critical for anyone involved with M&A deals. This course explains the three main deal types: asset acquisitions, stock acquisitions and mergers.

Hotshot

Due Diligence for M&A Deals

A primer on the due diligence process in M&A deals, including what due diligence is, its impact on a deal and tips for conducting a diligence review.

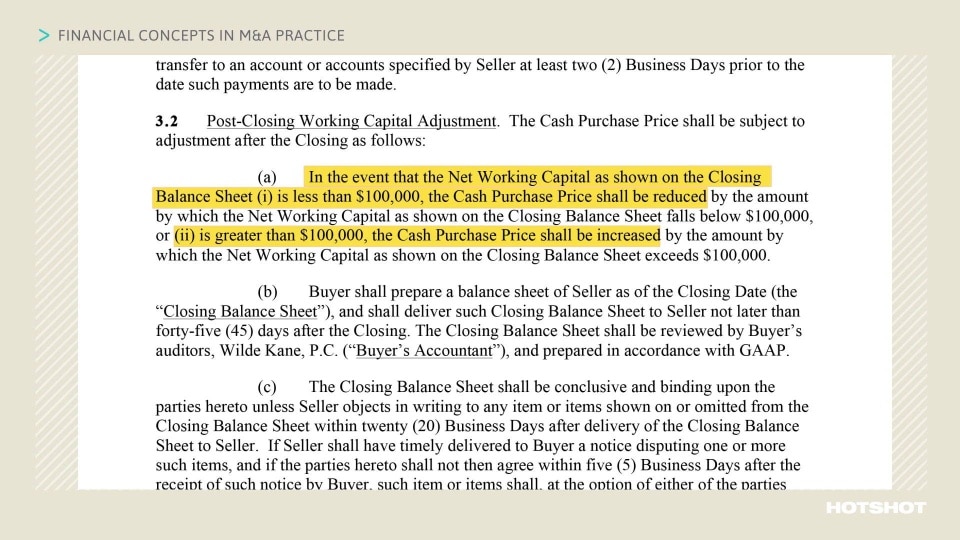

Hotshot

Financial Considerations in M&A Practice

The key financial concepts in M&A practice, including valuations, the main financial provisions in M&A agreements and general tax and accounting issues.

LISTEN

Check out these episodes from the How I Lawyer Podcast, a series by Georgetown Law professor Jonah Perlin.

Jonah talks to attorneys throughout the professions about what they do, why they do it, and how they do it well.

This podcast series is a great way to learn directly from attorneys about what the day-to-day work is like in different practice areas.

Eli Albrecht, Gibson Dunn

In this episode, Jonah speaks with Eli Albrecht, an M&A Associate at Gibson Dunn’s Washington D.C. office. Eli provides an overview of M&A practice as an associate, as well as his experience navigating the Sabbath within BigLaw as an Orthodox Jew and his online presence as a #lawdad.

Jason Bennett, Baker Botts

In this episode, Jonah Perlin speaks with Jason Bennett, a Partner at Baker Botts in Houston, Texas where he serves as the firm-wide chair of the Global Projects Practice as well as co-head of the firm’s Energy Sector leadership group.

Alé Dalton, Bradley

In this episode, Jonah Perlin speaks with Alé Dalton, an associate at Bradley LLP’s Nashville Office. Her practice focuses on healthcare transactional work where she provides counsel during mergers and acquisitions, as well as guiding clients through issues that arise from the complex nature of operating in a highly regulated industry.

PRACTICE

Check out these interactive exercises brought to you by Praktio, a modern training platform for reviewing and drafting legal documents. Use these exercises to practice these tasks, make mistakes, and learn from them!

Praktio has teamed up with Summer Associate Hub to make these exercises available to law students for free – these links will direct you to Praktio’s platform, where you may be required to create a free account.

These courses are a great way for law students to get a glimpse of M&A practice. We selected these exercises as only some of the key tasks on which corporate finance/lending associates work (and, of course, this practice involves many other types of exercises).

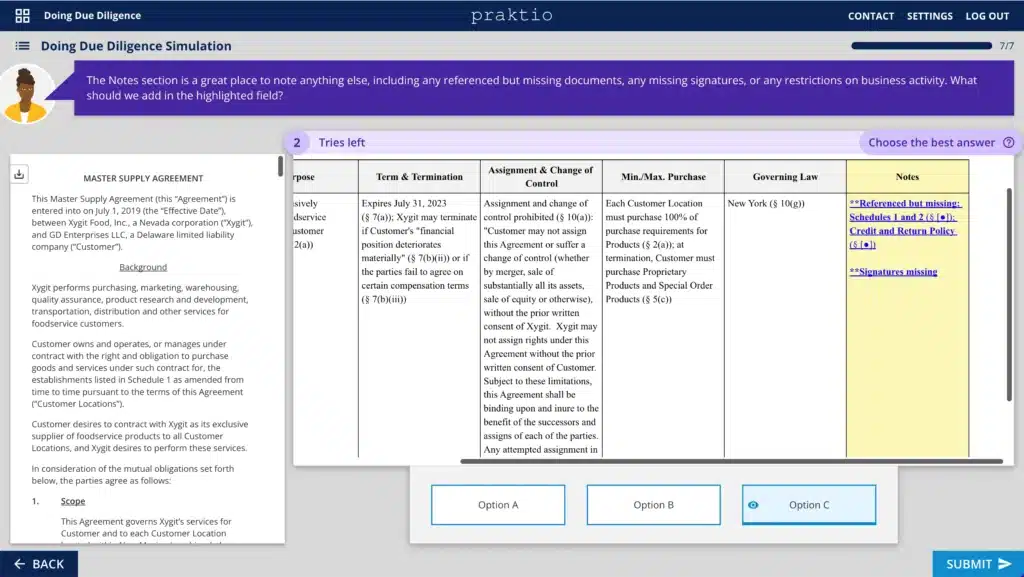

Praktio:

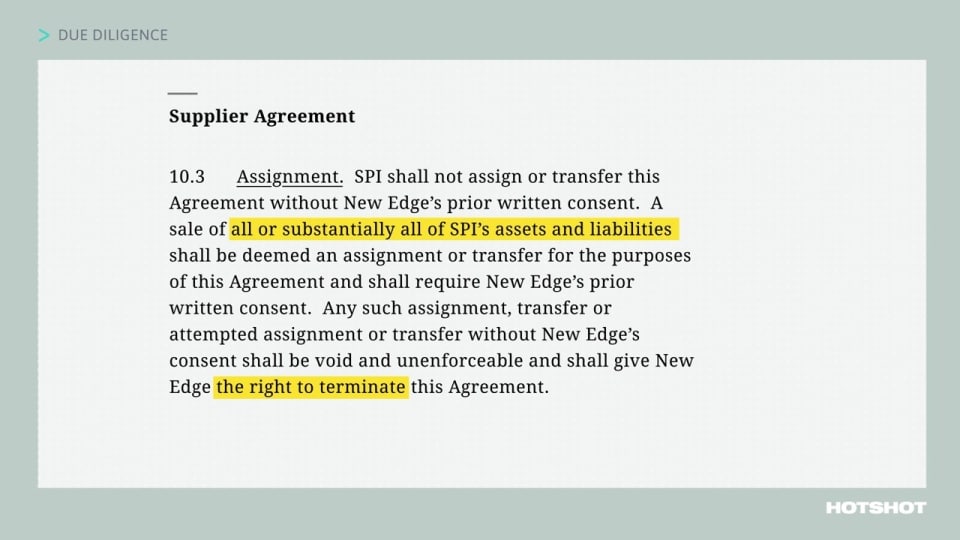

Doing Due Diligence

Learn how to review target contracts and chart key data points for practical use.

Due diligence of a company's corporate documents, agreements, and other items is one of the most common tasks for M&A associates. Due diligence goes hand in hand with drafting disclosure schedules, which are the subject of the exercise below.

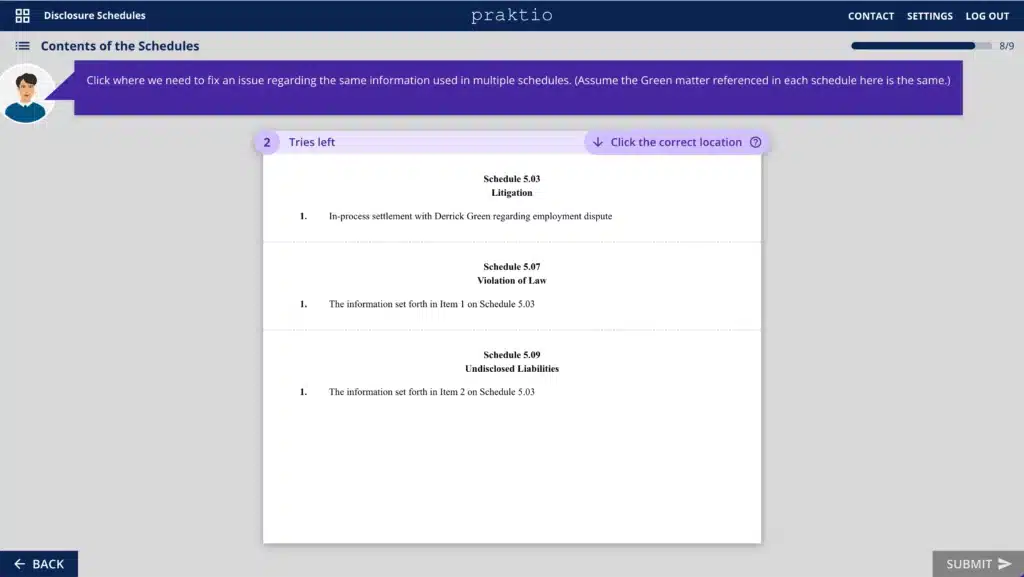

Praktio:

Disclosure Schedules

This course teaches how disclosure schedules work with the larger agreement and the diligence process to allocate risk between the parties.

Disclosure schedules are a key document in M&A transactions and one of the main items an M&A associate manages from the beginning to the end of a deal.

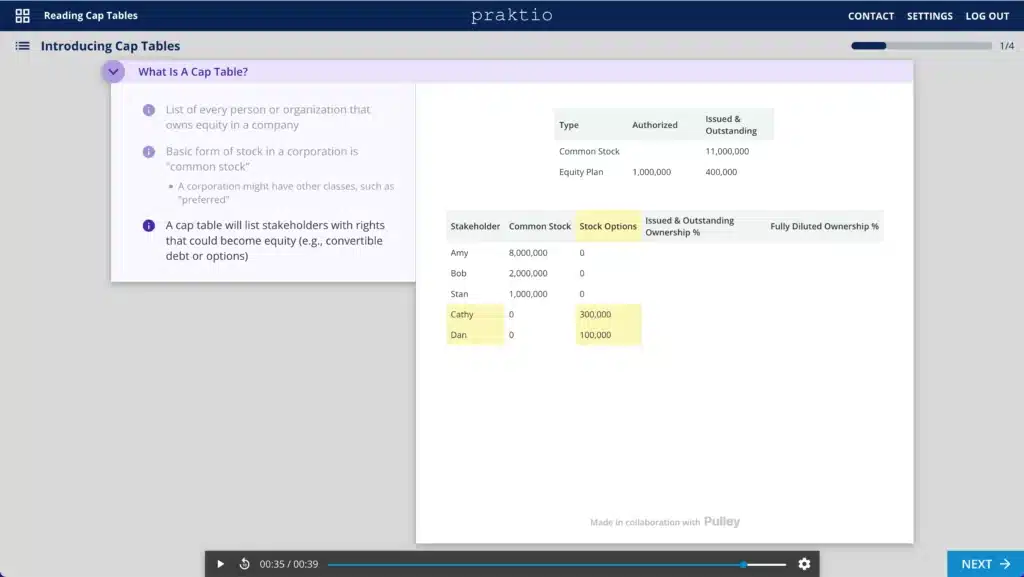

Praktio:

Reading Cap Tables

Learn how to read and reconcile capitalization tables.

Although it may be a more central part of EC/VC practice specifically, understanding cap tables is a very important skill for M&A attorneys as part of the transaction process.

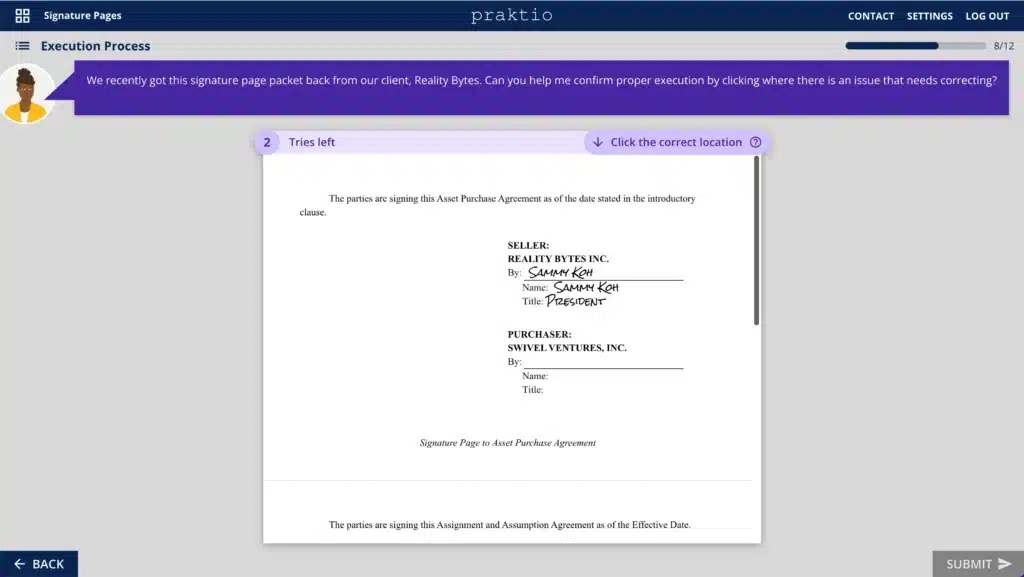

Praktio:

Signature Pages

Learn how to create, collect, and coordinate signature pages.

Signature pages are a key task for junior associates in any corporate practice, especially M&A. Because it is the vehicle for the actual signing and closing of the deal, which can involve signatures from dozens of parties, organizing accurate sig pages is a very important task for any transaction and something that clients rely on the law firm to handle reliably.

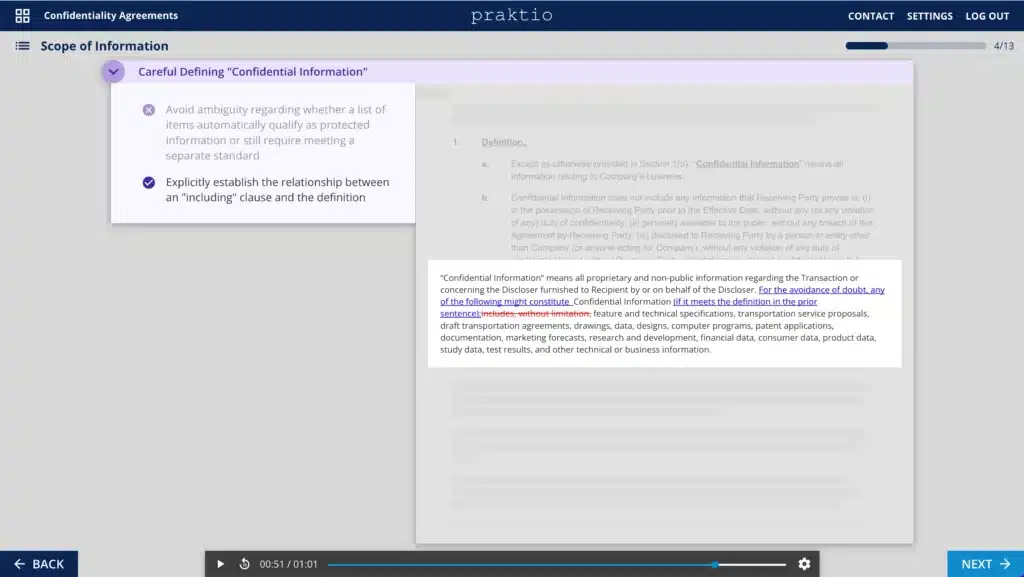

Praktio:

Confidentiality Agreements

Learn the key components, best practices, and pitfalls of confidentiality agreements.

Confidentiality agreements (or "NDAs") are common in M&A practice, and are often carefully negotiated at the very early stages of a deal.